Borislav Borissov

University of National and World Economy

https://doi.org/10.53656/his2025-6s-9-how

Abstract. The practice of developing state and municipal budgets in Bulgaria began immediately after the Liberation and reflects both the fiscal traditions of the Ottoman Empire and the desire for modernization and Europeanization of Bulgarian financial policy. Historically, various financial decisions have determined the degree of financial decentralization and the financial powers of local authorities, the role of internal control, the functions of financial specialists, tax policy, budget expenditure priorities, and more. Some of these decisions remain valid today, while others have been abandoned as unsuitable. The article provides a historical review of the budgetary practices of the Third Bulgarian Tsardom and a study of stakeholder attitudes towards key elements of modern budgetary policy. The aim of the article is to use the experience of the past to rethink certain decisions for the improvement of municipal budgetary policy. Questions are raised such as whether municipal councilors should receive remuneration for their work, whether financial decentralization should be expanded and deepened, whether it is necessary to introduce program budgeting at the municipal level, what the main sources of investment funds in municipal budgets should be, and others. The results of the survey show that there are old budget practices that are accepted as appropriate for our times, as well as those that are rejected. The opinions of the of mayors and municipal financial specialists and the review of past practices provide an opportunity to seek suitable solutions for improving the budget process in Bulgarian municipalities.

Keywords: historical overview; municipalities; budget practices; financial decentralization; local self-government

Introduction

After the Liberation in 1878, the Third Bulgarian State, divided into the vassal Principality of Bulgaria and the autonomous Ottoman province of Eastern Rumelia, began building its financial institutions. The financial system of the young state was a result of both the fiscal traditions inherited from the Ottoman Empire and the drive for modernization along European lines. The first budgets were not legislative acts but rather accounts of the necessary expenditures for building the state administration, creating its own army, improving infrastructure, education, and healthcare, and repaying foreign debts.

On March 1, 1879, Prince Dondukov-Korsakov approved the “Estimate of expenditures to be made from Bulgarian revenues from March 1, 1879, to March 1, 1880”. The first budget document of the Principality of Bulgaria contained only an expenditure section, expressed in French francs (Ministry of Finance, 2025). The municipal budget was called a „брой“ (count/tally). Article 64 of the Provisional Rules for City Councils, approved on September 5, 1978, states: “Around November 1st, the city council in its permanent composition, each year, presents to the general assembly of the members of the city council a “count” of the city’s revenues and expenditures for the coming year” (Sotirov & Lazarov 1937). From then on, the budget process developed and improved throughout the Third Bulgarian Tsardom, reflecting the country’s political, economic, and social changes. During the socialist era, it was centralized, much like the overall governance of the country, and after the political and economic changes of the early 1990s, the principles of local self-government were restored.

- Historical Review

The legal and institutional framework of the budget process in Bulgaria was established with the Tarnovo Constitution, adopted on April 16, 1879. In its Chapter XVII, consisting of only four articles, the Constitution specifies that the budget is drawn up for one year, approved by the prince, reviewed article by article, and that if, for some reason, a new budget cannot be adopted, the budget from the previous year remains in effect (Constituent National Assembly 1879, 2025). There were six ministries, including the Ministry of Finance. A year later, the Supreme Audit Office was established, which carried out subsequent control over the budget’s execution.

In March 1880, the next state budget was adopted, but it was effectively the first to be approved by the National Assembly. Its compilation was the result of the collective efforts of the government and the representatives of the Constituent Assembly, who worked together to determine the young state’s priorities and needs. This process was a key moment in Bulgaria’s history, laying the foundations for the country’s modern financial and administrative system.

In 1880, a law on taxes was adopted: the beglik (on sheep) and the serchim (on pigs), as well as a law on the emlak (on buildings and structures), idjar (on rental income), and temettuat (on income from professions) taxes. The Lev was introduced as the official currency of Bulgaria on June 4, 1880, with the adoption of the Law on the Right to Mint Coins. It replaced foreign currencies in circulation, such as Ottoman liras, Russian rubles, and Austro-Hungarian gulden.

In his article “First Steps in the Legislative Framework of the Budget and the Budget Process in Bulgaria. Budget Accountability Act”, R. Brusarski provides a comprehensive historical overview of the adoption of the first budgets and the legislation related to the budget process. He highlights the role of the French financial inspector Emin Queyet, who arrived in Bulgaria in 1881 at the insistence of Prince Al. Batemberg and who made a great contribution to the actual construction of the public finance system in our country according to the Western model (Brusarski 2024).

The Tarnovo Constitution introduced the right of self-government for municipalities and districts as administrative-territorial units, stating in Chapter I, Art. 3: “The territory is administratively divided into districts, counties, and municipalities. A special law shall be drafted for the regulation of this administrative division based on the principle of self-government of the municipalities” (Constituent National Assembly 1879, 2025).

In August 1879, Prince Alexander of Battenberg approved the “Provisional Rules for Urban and Rural Municipal Government” created by the government. According to these rules, the inhabitants of each populated place formed a municipality, and municipal councils consisted of seven to twenty-one members, depending on the population size. Only literate Bulgarian citizens with established residence in the respective municipality could be appointed as mayors.

On May 15, 1893, the Fourth Grand National Assembly was convened, which introduced changes to state institutions, increasing the number of ministries and consolidating the principle of two levels of local self-government – municipal and district (Metodiev & Stoyanov 1987). The normative basis for municipal self-government was regulated by the adoption of two laws – the Law on Urban Municipalities and the Law on Rural Municipalities, published in State Gazette no. 69 of July 19, 1886. The public services municipalities were responsible for included primary education, public works, healthcare, and social activities. These were financed through local budgets adopted by the municipal councils. Municipal councillors carried out their activities free of charge and elected a mayor and a deputy mayor from among their members. At the second level of local self-government – the district councils – a permanent body called the District Standing Committee operated, whose members were elected from among the district councillors. This committee dealt with the management of the district budget. A key criterion for the existence of real local self-government, in addition to the possibility of direct election of municipal councillors and mayors, was the existence of an independent municipal budget, with revenues administered by the respective local administration and expenditures made at its discretion.

Following the global economic crisis of 1929-1933, which also affected Bulgaria, and before the military coup of May 19, a fundamentally new Law on Budget, Accounting, and Enterprises was adopted on April 12, 1934. This law had no prototype in any foreign law and resembled the French and Belgian ones only in some major provisions (23rd Ordinary National Assembly, 1934). The National Assembly was dissolved and not convened until 1938, so there was no legislative body to adopt the budget according to the usual procedure under the Tarnovo Constitution (Art. 36). The government of Kimon Georgiev, and later that of General Pencho Zlatev, governed the country by issuing decree-laws – acts of the executive branch that had the force of law, were issued by the Council of Ministers, and were signed by the Tsar. Since the state budget is a legislative act, it was also adopted as a decree-law. For example, the 1935 budget was approved by a Decree-Law of January 31, 1935, on state revenues and expenditures for the 1935 budget year. This adoption procedure continued for each budget year during the period when there was no functioning parliament until 1938.

As Dimitar Sotirov and Ivan Lazarov, both controllers at the Ministry of Finance and authors of the Commentary on the Law on Budget, Accounting, and Enterprises, wrote, the fundamental principle upon which the financial policy of a modern democratic state is built is “the immutability of budget revenues and their binding nature for the executive branch” (Sotirov & Lazarov 1937).

Some of the new provisions in the Law, also concerning municipal budgets, were as follows:

- For making significant corrections to the municipal budget after its vote by the municipal council and before its approval by the district governor, the culpable official was subject to punishment.

- The inclusion of new revenue items was not permitted if their type was not established by a special law or by the Law on Urban and Rural Municipalities, nor was it allowed for municipal budgets to omit certain legally established revenues. Municipal budgets, although independent, were subordinate to the state budget and other laws, as municipal budgets were not laws but administrative acts.

- With the amendments to the Budget Law in 1935 and 1936, civil servants were given the right, depending on their position, to use first, second, or third class when travelling by train, paying only the price of a third-class ticket. The same rule applied to the daily allowances for business trips of civil servants in the country and abroad, which varied depending on their basic monthly salary.

- Representation allowances paid to civil servants were determined by the budget law, in conjunction with the law on civil servants. This also applied to municipal employees and the mayor.

- The Supreme Audit Office could annul decisions of the regional audit chambers regarding their refusal to recognize certain expenditures from municipal budgets.

- The draft budgets of municipalities and school boards that had loans or guarantees were reviewed by the Directorate of Public Debts before their approval.

- A strict regime was introduced for undertaking obligations payable after the respective financial year. Such commitments were allowed only by the Minister of Finance for a maximum period of three years and a maximum amount of 100 million BGN.

- The concepts of “good manager”, “foresight”, and “reasonable economy” were introduced. A good manager is one who, in their capacity as an official, exercises the care they would for their own affairs. Foresight means primarily protecting the interests of the state treasury, and a reasonable economy is one that does not lead to negative consequences.

- The concepts of “preliminary control” and “final control” were also introduced. In Art. 48 of Chapter VII “Control over the Execution of the Budget” of the Law on Budget, Accounting, and Enterprises, it is stated that preliminary control over expenditures consists of verifying whether the expenditures are necessary and lawful, while final control consists of verifying the supporting documents for the expenditure and authorizing the payment. Preliminary control was exercised by the budget control bodies of the Ministry of Finance, and for municipal budgets, by the budget control bodies of the municipalities. These were the state controllers for urban municipalities and the tax collectors for rural ones. Final control was carried out by the regional audit chambers.

- The duties of the budget control services and the so-called “accountants” are determined, i.e. the persons who collect and spend state sums, valuables and materials, as well as the persons entrusted with state warehouses, farms and exploitations. For their services as such, the accountants provide cash or bank guarantees to secure receivables that the budget may have as claims against them for uncollected amounts, unpaid interest, legal and other expenses. Article 106 of the Law on Urban Municipalities and Art. 103 of the Law on Rural Municipalities determine the amount of the accountants’ guarantees, which vary depending on the amount of budget funds for which they are responsible.

In the economic journals of that time such as “Municipal Review” and “Municipal Autonomy”, a wide discussion flared up about whether the verification of the necessity of municipal expenses also meant a verification of their expediency. Two opposing theses are advocated – one, by Ivan Petkov, a former advisor to the Supreme Audit Office, who in a series of articles entitled “Disagreements between the Mayor and the Accounting Officer”, published in the magazine “Municipal Autonomy”, vol. VIII, vol. 4 of January 1935 (Petkov 1935), according to which municipal accounting officers (controllers, tax collectors and tax secretary-accountants) as well as state ones, in addition to controlling the legality of expenses, must also exercise control over their expediency, the other by Ivan Yordanov, editor of the magazine “Municipal Review”, who in his article “Does Control for Expediency Exist in Municipalities”, published in vol. XIX of March 15, 1935, claims that the requirement valid for the general state budget is not valid for municipalities, which have their own independent budget, which is managed by the municipal mayor (Yordanov 1935).

Published from 1949 to 1985, the Journal of the Bulgarian Economic Society published a number of articles examining municipalities’ financial resource needs, the relationship between municipal budgets and the state tax system, and the role of municipal economic enterprises as generators of their own revenues. Such is the article by Al. Lyapchev “The Need of Municipalities and the Tax System of the State“ (Lyapchev 1907). In it, he discusses the financial difficulties of Bulgarian municipalities and their dependence on the state tax system. The article analyzes the discrepancy between the expanding functions of municipalities and their limited own revenues. The author examines structural problems in the state’s tax policy that hinder local self-government’s financial autonomy. The article is one of the early attempts to conceptually examine the relationship between the central and local budget processes and is an important source for the historical prerequisites of local financial decentralization.

In the yearbook XVI (1912) of the Journal of the Bulgarian Economic Society, several articles were published, devoted to municipal budgets and the financial management of local authorities. The focus is on the structure of revenues and expenditures in municipal budgets, the role of the state administration in controlling municipal finances and assessing the financial sustainability of municipalities in the conditions of modernization of the Bulgarian economy. These articles enrich the understanding of the development of local finances at the beginning of the 20th century and serve as a valuable historical context for comparative analyses. At a later stage, in 1941, D. Hristov, in his article “Volume and organizational forms of municipal economic enterprises in Bulgaria” presents a systematic analysis of municipal economic enterprises in Bulgaria in the first half of the 20th century (Hristov 1941). The author examines their volume, structure, legal and organizational forms and economic role in local finances. The study emphasizes the importance of municipal enterprises as a source of own revenues in municipal budgets and as an instrument for economic activity of local authorities. Hristov also emphasizes the challenges related to management, profitability and regulatory framework, which makes the work valuable for analyzing the historical evolution of municipal finances.

After the end of World War II, the political environment in Bulgaria changed radically, as the state began to follow the economic policy of the USSR and the other countries of the so-called „socialist camp“, which was characterized by centralized planning, prohibition of private property, lack of market mechanisms and competition, complete monopoly of the state, subsidization of certain economic sectors and the consumption of certain goods, targeting of budget expenditures towards priority goals set in national economic plans, lack of local self-government and financial decentralization.

Since the early 1990s, Bulgaria has returned to the principles of a market economy. Reforms in municipal governance are being carried out in accordance with the principles of the European Charter of Local Self-Government, which Bulgaria ratified in 1995. The principle of subsidiarity was introduced, which presupposes that public services should be provided by the authority closest to the citizens, i.e., the municipality. One of the main tasks of the new authorities became the implementation of real financial decentralization. As A. Zahariev writes, in the period 2002-2004 alone, a number of initiatives and changes in normative documents were undertaken, including: changes in the Law on Local Taxes and Fees, changes in the Law on Municipal Budgets, changes in the Law on Municipal Property, changes in the Corporate Income Tax Act, adoption of a Law on Municipal Debt, leading to a division of responsibilities between the state and municipalities and the introduction of standards for state expenditure responsibilities carried out by local authorities (Zahariev 2025). In 2022, a Concept and Program for Financial Decentralization were adopted, which were followed by the adoption of a Decentralization Strategy for the period 2006–2015 and a Decentralization Strategy for the period 2016 – 2025 (Ministry of Regional Development and Public Works, 2016). The practice of financing capital expenditures primarily with EU funds does not lead to the equalization of living conditions in municipalities but increases disparities, as the approval of their projects is not always based on clear and transparent procedures. This is evidenced by the fact that some municipalities have received three times as much per capita funding as others (Institute for Market Economics, 2025).

- Contemporary Attitudes

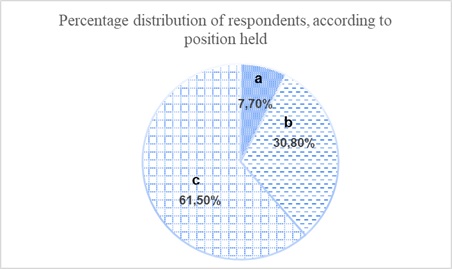

To study the attitudes of local government representatives toward old budget practices typical of the period of the Third Bulgarian Kingdom, the methods of retrospective analysis and direct survey were used. For this purpose, in August 2025, an electronic survey was prepared and distributed among mayors, municipal secretaries and financial specialists. During the period 28.08 – 23.09.2025, a total of 52 responses were received from respondents, whose responses are published here for the first time. The percentage distribution of respondents depending on the administrative position they held is shown in the following figure:

Figure 1. Percentage distribution of respondents, according to position held

Source: Author’s own construction

Legend: a – mayor

b – secretary

c – financial specialist

The first question aims to survey the opinion of local authority representatives regarding the introduction of a second level of local self-government, as was the case during the Third Bulgarian Tsardom. A similar discussion was very popular before the adoption of the Law on Local Self-Government and Local Administration in 1991 and in the following ten years. Only 15.4% of the respondents answered that local self-government should be introduced at the regional level. The vast majority (76.90%) believe this is not necessary, and 7.70% have no opinion. Indeed, considering that regional governors are appointed by the Council of Ministers and have almost no power to significantly influence the development of regional territories, lack the necessary budget for this, and have no strategic development documents, the creation of an elected body of regional councilors would mean a radical change in the way regional administrations are elected, their functions, and their powers. This can only be done at the expense of the powers of the higher or lower levels of government, i.e., by decentralizing functions and powers from the central government or by taking them away from the municipalities, which they would hardly agree to.

The desire of local authorities to strengthen decentralization and local self-government is evidenced by the answers to the next question: “Should financial decentralization be increased and in what areas?”. Only 7,7% answer that this is not necessary, while the rest indicate areas such as: expanding the scope of functions and tasks for which municipalities are directly responsible; the right of municipalities to introduce new taxes and fees independently; the right to determine the amount of existing local taxes independently; giving more rights to defend local autonomy; introducing delegated budgets for second-tier and lower-level budget spenders and reducing administrative supervision from the central government. The greatest preference is given to granting more rights to municipalities to defend local autonomy, which also means the right to independently determine the structure of the municipal administration in accordance with the needs of the population, the right to independently determine the amount of local taxes and fees, which are now limited within frameworks set by the Law on Local Self-Government and Local Administration, and to deepening financial decentralization to lower management levels. Here, however, it is necessary to emphasize that financial decentralization, which gives greater powers to management structures, must necessarily be linked to their ability to self-govern effectively, to perform their functions professionally, to make decisions affecting certain strata of the population transparently, and to prevent corruption. This is the reason why 11.1% of the respondents believe that decentralization should not be deepened due to the lack of sufficiently effective control over the work of second-tier and lower-level budget spenders.

The opinions of the respondents are quite contradictory as to whether municipal councilors should receive remuneration for their work as such or not, as was the case in the past. Of these, 53.8% answer that councilors should not receive remuneration as was the case in the past, while the remaining 46.2% believe they should. In Art. 34, para. 2 and para. 3 of the The Law on Local Self-Government and Local Administration, it is stated that a municipal councilor receives remuneration for participation in the meetings of the municipal council and its committees, the amount of which cannot be higher than 70% of the gross monthly salary of the chairman of the municipal council (for municipalities with a population of over 100,000) and the average gross salary of the municipal administration for the respective month (for municipalities with a population of up to 100,000). In practice, in almost all municipalities, councilors receive a fixed monthly remuneration, which is in no way linked to the number or duration of participation in meetings of the council and its committees. Since the majority of municipal councilors also work for another employer for an indefinite period or on a fixed-term employment contract, at least two questions arise here: first, does the councilor not violate the requirement of Art. 113 of the Labor Code, which regulates the maximum duration of working time under an additional employment contract together with the duration of working time under the main employment relationship, which cannot be more than 48 hours per week, and second, should the councilor not take unpaid leave from his main employer for the time he performs his functions as such?.

The next four questions in the survey relate directly to the budget policy of the municipalities. To the question “What kind of budget is preferable – with a deficit, with a surplus, or balanced?” only 7.70% of the respondents answer that a budget with a certain deficit is preferable, which would increase financial discipline in collecting and spending budget funds. The remaining 92.3% are of the opinion that the budget should be balanced so as not to increase the municipal debt. The comment here is that most representatives of local authorities are afraid of exceeding the normative frameworks for payments when taking on municipal debt, which is a major source for covering the budget deficit, but at the same time, practice shows that a conservative approach often leads to the accumulation of surpluses at the end of the budget year, which are spent without a plan and sometimes without control.

The next question is interesting, as it aims to check the readiness of local authorities to introduce program budgeting, an approach with proven benefits that ensures a link between program goals and budget expenditures and greater transparency in the spending of public funds. Currently, program budgeting in Bulgaria is mandatory only for high levels of government. The Public Finance Act regulates that a program budget format is applied by the first-level spending units of the Council of Ministers, ministries, and state agencies. It is specified that the Council of Ministers may also designate other first-level spending units to apply a program budget format, such as municipalities, but so far there is no such requirement for them. There is also no initiative from the municipalities themselves to apply this innovative approach, and they continue to follow a budgeting technology known for decades, where they first wait for the size of the subsidy from the national budget to be determined, then the control figures of the tax service for tax revenues, non-tax revenues are determined based on the collection rates in previous years, and finally, after calculations for the necessary expenditures are made, revenues are balanced with expenditures. This practice ignores the main requirement that the budget should be drawn up on the basis of developed strategies, forecasts, and proposals from the population. The vast majority of the surveyed representatives of municipalities (69.2%) believe that program budgeting should be introduced at the municipal level because it provides a link between the budget and the adopted programs, which are now optional and financially unsecured. Of all respondents, 15.4% answer that program budgeting requires additional efforts from financiers and therefore should not be introduced. The percentage of those who have no opinion is the same.

To the next question, “Do you think that the implementation of investment projects, mainly with funds from the European Union, leads to a reduction of disparities in the development of municipalities?” only 15.4% answer that the financing of municipal projects with funds from the European Union ensures the even and fair development of all municipalities, others 76.9% percent are of the opinion that the financing of projects with funds from the European Union benefits certain municipalities and leads to an increase in disparities between them, and 7.70% have no opinion on this matter. Perhaps this is the reason why most of the respondents (61.5%) to the question “Should revenues from European funds be included in the budget or be recorded off-budget?” are of the opinion that these receipts should continue to be recorded off-budget so as not to distort the true picture of the budget.

The last question of the survey, “What should be the main source of funds for capital expenditures of municipalities in the future, so that they can ensure sustainable development of the territory?” has four possible answers, which are:

– Funds from the European Union;

– Operating surplus, as the difference between budget revenues and budget expenditures;

– Targeted subsidies from the state budget;

– Provision of additional revenue sources, such as shared taxes (e.g., VAT, corporate tax, and personal income tax).

The answers are distributed almost equally between two of these options – 53.8% believe that the main source of funds for capital projects should be additional municipal or shared taxes, which should be granted to municipalities by law, while another 46.2% are of the opinion that state subsidies should be allocated for capital projects. Obviously, the latter answer does not correspond to the stated desire for greater financial decentralization.

Conclusions and generalizations

The review of some municipal budgetary practices from the time of the Third Bulgarian Tsardom and their comparison with the opinion of contemporary representatives of local authorities shows that some of them, although not existing now, are accepted as useful, while others are rejected. Among the useful practices is the fact that municipal councilors in the past did not receive remuneration for their activities as such. Currently, the remuneration of councilors is regulated by the The Law on Local Self-Government and Local Administration, and not by a higher normative act – the Labor Code, as they are not employees under an employment contract. This remuneration is similar to the fees paid to members of various bodies and commissions, but it is not subject to the rules for labor relations described in the Labor Code. Therefore, even if we accept that councilors’ remuneration should be paid, a clearer normative regulation and a link between its size and the actual work performed are necessary.

The study shows that the practice of financing capital expenditures primarily with EU funds does not lead to the equalization of living conditions in municipalities, but increases disparities, as the approval of their projects is not always done through clear and transparent procedures. This is evidenced by the fact that some municipalities have received three times more funds per capita than others (Institute for Market Economics, 2025).

It was interesting to find that the introduction of preliminary control of expenditures for legality and expediency is not a new provision, an idea of the Committee of Sponsoring Organizations of the Treadway Commission from more than 30 years ago and introduced in our country with the Law on Financial Management and Control of 2006, but a well-forgotten practice from the past. The same is valid for the modern concept of “reasonable assurance”, which has its analogue in the past as “reasonable economy”.

The idea of introducing a second level of local self-government in our country is not well received, as it would only increase bureaucracy rather than strengthen democratic principles. Most of the respondents are supporters of a balanced budget and the deepening of financial decentralization. They understand the advantages of program budgeting but do not show proactivity in introducing it in municipalities. Several issues of municipal financial practices in the past and now remain outside our attention, such as the type and size of local taxes and fees, the focus of extra-budgetary funds and accounts, the remuneration of municipal employees, the nature of investment costs, and others, which could be the subject of subsequent research.

Acknowledgements

The author thanks Petyo Petkov, a military judge, for providing me with the book “Commentary on the Law on the Budget, Accounting and Enterprises and the Regulations for its Implementation” by D. Sotirov and Iv. Lazarov, published and printed by D. Provadliev, Sofia 1937, with which he provoked my interest in the topic under discussion.

references

23RD ORDINARY NATIONAL ASSEMBLY, 1934. Law on the Budget, Accountability and Enterprises. State Gazette, issue 7. Sofia.

BORISOV, B. & GOSPODINOV, Y., 2025. Index of the Administrative Capacity of the State Administration of the Republic of Bulgaria for 2024. Academic Publishing House “Tsenov”.

BULGARIAN NATIONAL BANK, 2024. Mandate and Functions of the Bulgarian National Bank 1879 – 1947. Volume I: Regulatory Framework for the Activities of the Bulgarian National Bank. Sofia: Bulgarian National Bank.

CONSTITUTIONAL NATIONAL ASSEMBLY. 1879. Constitution of the Bulgarian Principality, 1879.

HRISTOV, D., 1941. The volume and organizational forms of municipal enterprises in Bulgaria. Reports of the Bulgarian Economic Society.

INSTITUTE OF MARKET ECONOMICS, 2025. 265 stories about economics.

INSTITUTE OF MARKET ECONOMY, 2025. State of municipal budgets in Bulgaria and opportunities for expanding the financial autonomy of local authorities. Sofia: IME.

KOLEV, V., 2006. Municipalities in Bulgaria (60s and 80s of the 19th century). Sofia: IF-94.

LYAPCHEV, A., 1907. The needs of municipalities and the state tax system. Reports of the Bulgarian Economic Society, vol. 11, no. 8–9, p. 614.

METODIEV, V. & STOYANOV, L., 1987. Bulgarian state institutions 1879 – 1986. Sofia: Dr. Petar Beron Publishing House.

MINISTRY OF FINANCE. n.d. Chronicles.

MINISTRY OF REGIONAL DEVELOPMENT AND PUBLIC WORKS, 2016. Decentralization Strategy 2016 – 2025. Sofia.

MRRBW, 2016. Decentralization Strategy 2016 – 2025. Ministry of Regional Development and Public Works.

PETKOV, I., 1935. Disagreements between the Mayor and the Reporter. Municipal Autonomy, vol. VIII, book 4.

SOTIROV, D. & LAZAROV, V., 1937. Commentary on the Budget, Reporting and Enterprises Act and the Regulations for its Implementation. Sofia: D. Provadliev.

YORDANOV, I., 1935. Is there a control for expediency in municipalities. Municipal Review, vol. XIX.

ZAKHARIEV, A., 2025. Financial Decentralization – Cross Analysis and Empirical Evidence. Sofia: VUZF “St. Grigoriy Bogoslov”.

HOW MODERNITY PERCEIVES HISTORY. HISTORICAL OVERVIEW OF THE MUNICIPAL BUDGETARY PRACTICES OF THE BULGARIAN STATE

Prof. Borislav Borissov, DSc.

ORCID iD: 0000-0002-0350-7929

Institute of Economics and Politics

University of National and World Economy

Sofia, Bulgaria

E-mail: b.borissov@unwe.bg

>> Изтеглете статията в PDF <<